He pioneered functional neurosurgery in China and was the "first person in cell knife" in China … … In the field of functional neurosurgery in China, Li Yongjie is a "myth". Under the dazzling aura, in essence, he will always be a scientist doctor who constantly explores new fields and a doctor who stands in the way of death and disease.

Li Yongjie is a 79-grade college student — — After the reform and opening up, the first batch of college students changed their fate through the college entrance examination. In the early 1990s, with the tide of studying abroad, he learned "one-handed" skills in traveling to the west. Although he got the green card, he resolutely gave up the choice of returning to China. In just 20 years, he created and led a discipline to rank among the international "first phalanx" … …

At the time of 40 years of reform and opening up, the 1.5 million-word book Functional Neurosurgery edited by Li Yongjie was published. A book, a person; A discipline, an era … …

Open Functional Neurosurgery, walk into xuanwu hospital Institute of Functional Neurosurgery and Beijing Institute of Functional Neurosurgery of Capital Medical University, approach Li Yongjie’s team, and learn about the development of functional neurosurgery, as if seeing the dance of "brave" on the tip of a knife, and the wonderful dance skills are the never-ending steps … …

▲ Family photo of 2018 Beijing Institute of Functional Neurosurgery. Photo courtesy of respondents

Xinhua Daily Telegraph Press Conference Morality

At the fork of Zheng Xinyi’s fate, Li Yongjie, his attending doctor and director of Beijing Institute of Functional Neurosurgery, stood there with a smile — — It was he and his team who realized the dream that "China Forrest Gump" had broken one place through surgery.

July 12th is the 20th anniversary of the first "cell knife" operation in China. Xinhua Daily Telegraph reporter entered the organization that has become the largest number of brain pacemakers implanted in the world for 10 consecutive years — — Xuanwu hospital Institute of Functional Neurosurgery and Beijing Institute of Functional Neurosurgery of Capital Medical University.

He was admitted to Peking University in 1979, studied abroad in 1994, and returned to China 20 years ago to establish the Beijing Institute of Functional Neurosurgery. A few years ago, he began to explore the society to run doctors and set up outpatient departments to help more people see and be optimistic about the disease … … In the recent 40 years, Li Yongjie’s fate has been closely linked with the changes of a discipline and an era.

▲ Professor Li Yongjie.

Open your eyes and see the world:

From "the first person in cell knife" to "a seed"

The human brain is one of the most amazing and complicated substances in the world. To move a "knife" on the brain requires not only courage, but also "real kung fu".

The operation that Li Yongjie cured Zheng Xinyi was called "Deep Brain Stimulation Operation". Simply put, it is to put electrodes deep in the human brain. The scientific principle is that the dyskinesia of human body is caused by pathological changes in some brain cells, and their symptoms can be controlled and regulated by electrical stimulation of the pathological cells.

▲ Professor Li Yongjie performs stereotactic surgery for patients.

Such an operation sounds simple, but in fact, human beings didn’t realize the relationship between human brain and consciousness and behavior until the end of the 19th century. The accurate treatment of brain tissue by surgery can be traced back to the emergence of stereotactic technology in 1947 — — At that time, the disease targeted by this technology was Parkinson’s disease, which was called "immortal cancer".

At first, the patient’s hands and feet showed rhythmic tremor, slow movement, difficulty in tying shoelaces and buttons, and difficulty in putting on and taking off shoes and socks. After 5 to 15 years of illness, he gradually lost his mobility … … Parkinson’s disease is a slowly progressive disease, which mainly occurs in middle-aged and elderly people. Muhammad Ali and mathematician Chen Jingrun all suffered from this disease.

In 1994, Li Yongjie, who had just gone abroad for postdoctoral studies, first came into contact with the cutting-edge microelectrode-guided stereotactic neurosurgery. This is a technique to stop the patient’s body tremor by destroying the "tremor cells" in the brain, which is vividly called "cell knife".

As a neuromodulation surgery, it uses stereotactic method to locate accurately, implants stimulation electrodes in the human brain, and controls the stimulation parameters of the electrodes in the brain through the remote control device in vitro, so as to control and improve the patient’s disease symptoms. It is the most successful case for human beings to realize the dream of "brain-computer dialogue".

"This kind of deep brain stimulator, also known as brain pacemaker, is the most advanced technical means for the treatment of functional encephalopathy in the international medical community since the beginning of the 21 ST century, among which the treatment of Parkinson’s disease patients is the most mature and common." Today, Li Yongjie still remembers the shock of that moment.

After the patient who was treated in the operating room was accurately located in the skull, a very thin electrode went deep into her brain to find the abnormal cells, and then it was "destroyed" by radio frequency heating. Within a few seconds, the violent tremor of the patient’s right hand disappeared, and her tears welled up in her eyes: "Oh, my God, it’s stopped for 10 years … …”

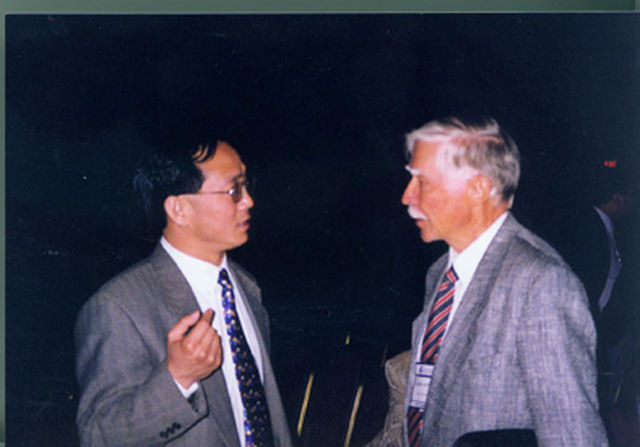

▲ The Institute was established in 1998-Dr. RP-Iacono, a famous functional neurosurgeon from the United States, came to congratulate him personally.

"The whole world seems to be silent, and I can only hear the voice in my heart: I must master this technology!" Li Yongjie, 57, will never forget the moment when he decided his future academic direction and even his life destiny.

At that time, this advanced surgical technique was still a blank in China, and doctors also called Parkinson’s disease "tremor paralysis". Li Yongjie, who has been a doctor of medicine in China for several years, knows very well that there are tens of millions of patients with nervous system functional diseases like Parkinson’s disease in China, and high-level brain surgery intervention is urgently needed.

After graduating as a postdoctoral fellow, Li Yongjie did not hesitate to join the world-renowned stereotactic neurosurgery — — The medical center of Linda University in Rome has mastered all the techniques of "cell knife" in only two years.

"There are so many patients in China, I want to go back to China and bring back the technology I have learned!" Li Yongjie’s inner voice rang again. Comfortable life, clean environment, American green card … … Nothing can stop him from returning to China.

"I left without hesitation." Li Yongjie said firmly.

▲ On July 12th, 1998, Li Yongjie completed the first stereotactic cell knife operation in Beijing Institute of Functional Neurosurgery.

On July 12th, 1998, the first "cell knife" operation in China began in xuanwu hospital. Li Yongjie, who returned from school, is a surgeon, anesthesiologist, radiologist and nurse … … Because no one knows how this "sophisticated" operation is done, he needs to personally control every link.

Heading, taking the patient to the nuclear magnetic room for brain scanning, positioning the surgical target, calculating the target position, craniotomy, drilling, inserting a very fine puncture needle to reach the target position, and inserting a microelectrode &hellip along the needle track; … Unconsciously, eight hours passed, and Li Yongjie, who was immersed in it, didn’t feel it at all. The doctors and nurses on the sidelines saw that the error of electrode positioning was less than 1 mm, and the patient’s trembling hand gradually stopped during the operation.

"The human brain is a black box. Stereotactic technology is a bit like GPS and must be accurate to the millimeter." Li Yongjie said.

Functional Neurosurgery Newsletter is a peer-to-peer exchange publication run by the Institute. The cover of the 10th issue published in April 2012 is a picture of Swiss national hero william tell aiming at an apple on his son’s head not far away under the oppression of colonists.

"Through the distant time and space, we are capturing William’s breath in the picture, pulse diagnosis’s pulse, and appreciate each other’s heart is sympathetic." Li Yongjie wrote in the article "Courage and Responsibility Create Glory" on the front page of the magazine, "Because our profession is a doctor who saves lives, and the disease is ‘ Magic ’ The doctor is a bow and arrow maker. Facing the eyes of patients seeking help or even despair, facing the challenges of difficult and complicated diseases, and facing the medical risks and sociological risks brought by treatment, we are tested and challenged every day. This not only requires our confidence in our own knowledge and skills, but also challenges our courage and responsibility. "

Neurosurgery, especially stereotactic surgery, is like shooting an apple with a bow.

"This requires a high degree of accuracy, and no mistakes are allowed, so as to ensure that patients are safe, and ‘ Shoot ’ The disease is invisible. " Li Yongjie said.

"It feels amazing." Lu Xiaoli, a doctor who witnessed the whole operation, remembers that after the success of the operation, more and more patients came here. By the end of 1998, Li Yongjie’s team had been able to perform dozens of "cell knife" operations every month, and a set of scientific operation standard procedures were established, and the operation time was shortened to an average of two hours.

"I am just a seed, bringing this technology back to China and blossoming everywhere." Li Yongjie, who is known as the "first person of cell knife", said modestly that if he has made any contribution, it is to make the stereotactic technology develop more finely and safely in China.

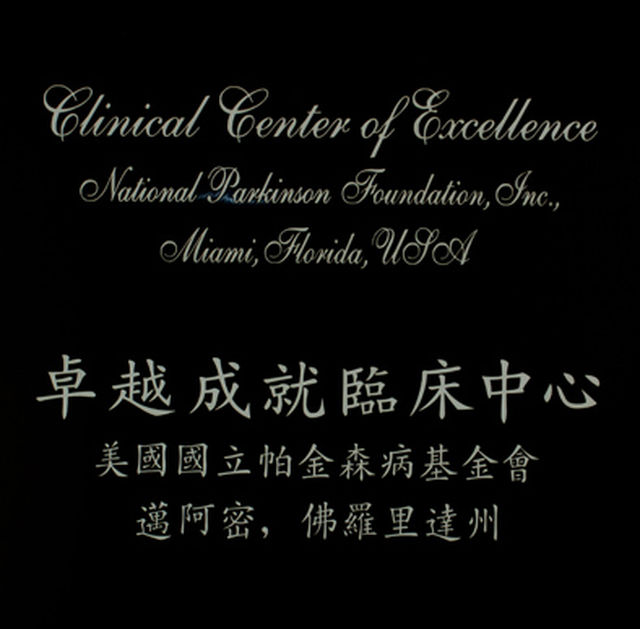

▲ In 1999, the National Parkinson Foundation awarded Beijing Institute of Functional Neurosurgery the title of "Clinical Center of Excellence".

Parkinson’s disease is the most common type of dyskinesia. Epidemiological statistics show that there are 2 million patients in China, accounting for 40% of the total number of patients in the world. Due to the aging of the population, the incidence of Parkinson’s disease is still increasing, and it has become one of the common diseases in the nervous system of middle-aged and elderly people.

In 1817, the British doctor Parkinson confirmed Parkinson’s disease in his book "On Tremor Paralysis", and then the international medical community named the disease after him.

"This year is 201 years since Parkinson’s disease was confirmed." Li Yongjie said, "Before I went abroad, the name Parkinson’s disease had been used abroad for more than 100 years, and this disease was still called ‘ Tremor paralysis ’ . Now the country is also called Parkinson’s disease, which is the result of everyone opening their eyes to see the world. "

The pioneering and exploration of Beijing Institute of Functional Neurosurgery has made countless patients see hope.

As of July 12, 2018, in the past 20 years, Beijing Institute of Functional Neurosurgery has performed stereotactic surgery for 6,690 patients with dyskinesia, involving 13 types of functional neurosurgical diseases: Parkinson’s disease accounts for more than 3/4, followed by primary tremor (10.87%) and dystonia (7.17%), and other dyskinesia only accounts for 5.74%— — Include cerebral palsy, TIC disorder, Parkinson’s superposition syndrome, voluntary movement’s disease, chorea, etc.

"At the beginning of returning to China for three or five years, we were fighting alone. In the last five or six years, hospitals and universities everywhere can’t wait to develop functional neurosurgery. " Li Yongjie said.

▲2009-9-18- Professor Ali-Rezai, an American expert on dyskinesia, visited and Professor Li Yongjie signed a book.

The brave are invincible:

Let functional neurosurgery blossom in China in 20 years.

Starting from the first "cell knife" operation 20 years ago, China has established a multi-level and all-round discipline framework of functional neurosurgery, which focuses on dyskinesia, epilepsy surgery and pain, and spreads to neuromuscular spasm and psychosurgery.

Li Yongjie’s "battlefield for one person" has also become a "team competition".

At that time, xuanwu hospital established the Beijing Institute of Functional Neurosurgery because of his return, which is the first clinical treatment and scientific research institution in the field of functional neurosurgery in China. Since 2009, it has become the world’s largest "Deep Brain Stimulation Treatment Center", and the number of brain pacemakers implanted has been the first in the world for 10 consecutive years.

"This is the result of a team competition, but the high technology of the brain stimulator comes from the other side of the ocean. No matter how big the implant is, it just follows, not leads." Li Yongjie is very sober. "It’s my real mission to return to China to start a business, not to be a flash in the pan, but to develop steadily."

Faced with the huge medical demand and the blank field of functional neurosurgery in China at that time, the doctor with elegant appearance and slow speech showed the well-known word "courage" and shouldered the two burdens of talent training and discipline construction.

It is hard to imagine that when Li Yongjie cured Zheng Xinyi’s "spastic cerebral palsy" in 2010, brain electrode implantation was still in the early clinical exploration in the world. This means that his frontier exploration will inevitably have the risk of failure.

Li Yongjie admits that although he "cherishes feathers", he wants to be a good brain surgeon, "focusing on intelligence in the short term, ability in the medium term and responsibility in the long term". To this end, he set a rule for surgery: "I will do the most difficult, latest and risky surgery!"

▲ Professor Li Yongjie performs endoscopic surgery.

Once, Li Yongjie met an epileptic with a particularly complicated condition. After she failed in an operation in a foreign country, she was introduced to see a doctor by a medical elder. But after an impeccable craniotomy, her condition actually relapsed. This means that the previous judgment of the lesion is likely to be wrong.

When Li Yongjie was called to the ward by his colleagues, what he saw was such a scene: the patient’s mother was sitting on the windowsill, desperate. Based on careful observation, Li Yongjie made a decisive second craniotomy and confirmed that the real lesion was in the parietal lobe of the brain, less than 2 cm away from the motor cortex of the brain.

Do you want to do the third craniotomy? Who will do it? Li Yongjie did not hesitate to stand before the operating table. He carefully removed the focus cells as big as the fingernail, avoiding the dangerous motor cortex injury.

"The patient is only 16 years old. If he is paralyzed by surgery, the young doctor may not be able to bear this huge psychological burden, then I will come." He smiled and recalled as if those thrilling "moments of life and death" were as usual.

Dr. Lu Xiaoli, who has been following him, commented that he was "not angry and arrogant" — — "When he is around, everyone relies on him from the heart, which is the personality charm of Professor Li".

He is honest with others.

"If you don’t look at it, as long as I pick it up, I must be responsible for the patient to the end." Li Yongjie said, "It must be that those who dare to take responsibility make rapid progress, and those who are afraid of accidents make slow progress. In the end, it is better than taking responsibility."

"Teacher Li often tells us that being a good doctor is the first priority. For diseases that can be cured, the treatment should be serious and accurate, and the best treatment plan should be discussed for difficult cases. For diseases that have no treatment for the time being, patients and their families should correctly understand and face the disease positively. ‘ Sometimes it’s healing, often it’s helping, always comforting ’ 。” Zhou Changshuai, a student in Li Yongjie, once quoted this sentence to describe his mentor in an article entitled "The Short Story of big doctor".

More than 100,000 patients from all over the world were diagnosed and treated, and more than 10,000 cases were treated by surgery … … After 20 years, Li Yongjie has realized his ambition of returning to China: 16 "Xuanwu workshops" for hospitals across the country have trained a high-level "national team" of functional neurosurgery and trained thousands of doctors across the country; Cutting-edge technologies such as "cell knife", deep brain stimulation and endoscopic surgery have been introduced into China, and the number of diseases that can be diagnosed and treated has expanded to more than 30.

"I am obsessive-compulsive disorder and perfectionist." Li Yongjie said, "Scientific research is a kind of spirit, attitude and method. To treat scientific research as work and work as scientific research, we must understand and clarify, run the spirit of scientific research through our work, and constantly expand the scope of application of technology."

Someone asked Li Yongjie, "Aren’t you afraid to teach your disciples and starve your master?" He laughed: "I have so many new technologies and fields to learn, how can I have time to think about them?"

▲ Professor Li Yongjie is doing popular science propaganda in the column "The Road to Health".

Parkinson’s disease, primary disorder, dystonia, TIC disorder, voluntary movement’s disease, cerebral palsy, myotonia and other motor disorders, various epilepsy diseases, chronic pain such as central pain, peripheral nerve injury pain, cancer pain, visceral pain, soft tissue pain, low back pain, neck and shoulder pain, and neurospinal diseases such as lumbar disc herniation and cervical disc herniation & HELIP; … Experts from Beijing Institute of Functional Neurosurgery have treated or operated on more than 30 diseases recorded in Functional Neurosurgery.

"In the field of functional neurosurgery, a comprehensive platform for treating diseases like ours can’t be found all over the world." Li Yongjie’s tone is gentle, but he is confident and proud. "In 20 years, I set up a platform for discipline development and brought out a team. Even if I retire, this subject will continue to develop. "

In the conference room of the Institute of Functional Neurology, picture frames are hung on the wall in order, and each one is longer than the other — — Because this is the annual photo of the Institute.

"Under the leadership of Director Li, our group photo lasted for 20 years. We are a big family and the team is getting bigger and bigger, so the group photos are getting longer and longer. " Lu Xiaoli said.

Looking back on the 40 years of reform and opening-up, Li Yongjie was filled with emotion: "We have caught up with the era of reform and opening-up, which is the best and fastest period of economic, social, knowledge, science and technology development in China for thousands of years. From an ignorant teenager to a medical expert and academic leader, from an entrepreneur with dreams to the ideal landing and rooting, my growth and harvest are all thanks to the times. "

"From an idiotic dream to a dream come true, I am more like the child running on the beautiful beach. Among the sea goods surrounded by waves on the beach, I am delighted to find several colorful shells … … Looking around, there are so many such children! "

Ten years ago, Li Yongjie wrote this passage with emotion, which is meaningful today.

▲ In 2015, Professor Li Yongjie won the title of "Top Ten Health Guards in the Capital".

Always on the road:

A restless scientist

Sharpen a sword in 20 years.

The team of more than 100 people led by Li Yongjie has become the world-famous "China Team" in the field of functional neurosurgery, and ranks among the international "first phalanx" — — Beijing Institute of Functional Neurosurgery was awarded the title of "Clinical Center of Excellence" by international institutions as early as 1999, becoming the only clinical institution in Asia to receive this honor.

What else does he want?

"I am a restless person, and I naturally like to do something new and different." There was a childlike look on his face. "I hope to be recognized as a scientist doctor."

In fact, it was Li Yongjie’s childhood dream to be a scientist, but it was accidental to study medicine.

In 1960s, he was born in an ordinary family in Datong City, Shanxi Province. In that special time when "sports followed sports", Li Yongjie was a "silent, timid" child because of his family background of "rich peasants", and he was "aged and lonely out of proportion to his age".

But under his seemingly "juvenile maturity" appearance, there is an interesting and curious soul hidden. He loved natural science since he was a child, and when he was 6 years old, he had a whim to make a perpetual motion machine with water currents and waterwheels. After the Tangshan earthquake, he hung a small hammer with enameled wire and passed through the ring. As long as it shook, it would trigger the ringing of the electric bell. He was very proud of this homemade "seismograph". At the age of 15, he climbed onto the roof to install an antenna, and the self-made "crystal receiver" actually received china national radio’s voice … …

In 1977, China resumed the national college entrance examination and entered the "scientific spring" with emphasis on education and knowledge.

"The resumption of the college entrance examination has restored the vitality of the social class." In 1979, Li Yongjie, who won the first prize in Shanxi Physics Competition, gave up the opportunity to attend the university of Shanxi Province without taking the exam and chose to take the college entrance examination, and was admitted to the top 20 in the province. His mother said, "If only our family could have a doctor, you could study medicine", which made him filial and medicine accompany him ever since.

In 1991, Li Yongjie, who received a doctor’s degree in medicine from Shanxi Medical University and published two English papers in Brain Research magazine, saw the huge gap between domestic and foreign advanced technology. A strong thirst for knowledge made him "desperate" and sold his newly allocated house to study abroad.

"My growth and harvest are all thanks to the times. If I don’t catch up with the golden age of 40 years of reform and opening up, I may not be able to dominate my own destiny." He said, "Therefore, I firmly believe that my seed will be the home only if it falls on the land of the motherland, and it will grow most vigorously."

"The door of opportunity opened by reform is getting bigger and bigger, and the chances that individuals can dominate their own destiny are getting higher and higher." Li Yongjie, which chose to return to China, has indeed achieved "the most vigorous growth" — — Under his leadership, Beijing Institute of Functional Neurosurgery keeps track of the latest development of functional encephalopathy in the world, improves technical methods, improves the level of treatment and expands the scope of treatment.

▲ In 1999, Professor Li Yongjie communicated with the Swedish doctor LV-Laitinen, a pioneer of functional neurosurgery.

In March 1999, the Institute of Functional Neurosurgery successfully treated Parkinson’s disease with subthalamic nucleus destruction technology, and in the same year, deep brain stimulation technology (brain pacemaker therapy) was developed to treat Parkinson’s disease.

In May, 1999, the first operation to treat generalized torsion spasm was successful.

In the second half of 1999, the first operation to treat spastic torticollis, chorea and Tourette’s syndrome was successful one after another.

In the new century, after creatively expanding the scope of surgical treatment to other dyskinesia diseases, his team began to pay attention to the work in the field of surgical treatment of epilepsy and pain … …

"Yongjie’s team has always led the development of functional neurosurgery in China, from treating Parkinson’s disease to epilepsy to pain … …” Professor Yuxi Liu of Shanxi Medical University said.

In the past three years, the average annual operation volume of Beijing Institute of Functional Surgery was over 1,600, and a team with their own strengths and vitality also grew up — —

Zhang Guojun and Yu Tao focus on the localization of epileptogenic focus and microsurgical treatment of intractable epilepsy; Hu Yongsheng specializes in surgical treatment and nerve regulation of chronic pain; Zhu Hongwei is good at neurospinal and cranial neuropathy; Li Jianyu has 20 years of experience in surgical treatment of dyskinesia … …

▲ Professor Li Yongjie gave a keynote speech at the 2017 Chinese Conference on Functional Neurosurgery.

In September 2017, the Huaxia Conference on Functional Neurosurgery was held in Beijing, and more than 20 top scholars in the world and more than 100 well-known experts in China arrived as scheduled.

In his speech at the conference, Li Yongjie introduced the summary of the world’s largest surgical cases of dyskinesia completed by the Institute in the past 20 years: a total of 6,467 cases were treated by surgery, and it was also found that the risk of Parkinson’s disease in men was 1.46 times that of women, and the overall dyskinesia was 1.45 times; At the age of onset, half of the patients with Parkinson’s disease developed before the age of 53, and half of them received surgery before the age of 61.

In the first 10 years after returning to China, Li Yongjie devoted himself to improving the diagnosis and treatment of Parkinson’s disease and epilepsy to the international level, and then he turned his attention to the treatment of chronic pain.

"The most common and harmful pain is disc herniation. My focus now is how to make it more meticulous and minimally invasive, in line with international concepts and models." He said.

Exploration is always on the road — —

"Science, solve ‘ Day ’ The problem; Technology, solve ‘ Land ’ The problem. I am still optimistic about the prospect of surgical treatment of emotional disorders such as major depression, hoping to find that key and open the door to the connection between heaven and earth. " He said.

▲ Professor Li Yongjie spoke at the 10th anniversary celebration of Beijing Institute of Functional Neurosurgery.

Li Yongjie, a member of the Standing Committee of the Beijing Municipal Political Consultative Conference, has repeatedly encouraged and called for the reform of the medical system. He has also done his best: in 2014, he promoted social capital to set up the Beijing Xidian Clinic, so that the advanced national specialized medical model can take root and explore a new path of graded diagnosis and treatment.

"Medical reform has entered the deep water area, which requires not only the skills of those who bow and arrow ‘ Emboldened ’ It requires the sense of responsibility of those involved in medical reform and the courage and responsibility of reformers. The reform of the medical system is risky, and it is even more risky if the medical system is not reformed. Go on the road with responsibility, courage and responsibility, because we believe that after twists and turns and even dangers, we will eventually reap glory. " Li Yongjie’s words spoke out the common aspiration of the participants in the western clinic.

"Every discipline has its scientific, systematic and complete requirements and development expectations … … As far as I am concerned, more than 20 years of study, research, practice and teaching experience in the field of functional neurosurgery are even more eager for it. " In 2018, Li Yongjie led the team to compile the lifelong learning and practice into a 1.5-million-word masterpiece Functional Neurosurgery. "The editorial team adheres to the concept of combining theoretical interpretation with clinical practice, and hopes to weave a whole picture in the field of functional neurosurgery with this context, hoping that it will become a classic in the field of functional neurosurgery."

"Patients with functional diseases of the nervous system account for more than 10% of the total population, and there are tens of millions of people who need interventional therapy. The number of people who can benefit from surgery is conservatively estimated to be as high as 5 million, which is about 10 times that of patients with brain tumors. Such a huge demand for medical services cannot be ignored, and historic opportunities for discipline development should not be missed. " He appealed in the preface.

In October 2017, Zhu Hongwei and Zhang Jiaxing of Beijing Institute of Functional Neurosurgery participated in an important international academic conference in neurosurgery, and found that this conference "no matter the lecture content or the frontier field display, the function and nerve spine account for nearly half, and everyone is working hard on stereotactic, navigation and artificial intelligence … …”

"This conference really shows the future development direction of neurosurgery, from which we can see our shortcomings and our status. It is proud that many of the work of the Beijing Institute of Functional Neurosurgery is at the forefront of the world. I believe that in new fields, we will also keep up with the international pace and make our own characteristics in the field of neurospinal surgery. " Zhang Jiaxing said.

▲ Playing basketball is Li Yongjie’s favorite sport.

In the face of achievements, Li Yongjie was unusually sober.

"We let the international advanced technology take root and bear fruit in China, and even ran away with international counterparts in clinic. Of course, there is innovation in this, but deep brain stimulation technology was invented abroad, and we still lack real original inventions. We need to open up new fields and invent new equipment, and start with creativity, research and development, market development and resource integration to establish a complete chain of scientific research and industrial development. " Li Yongjie said, "From quantitative change to qualitative change, this possibility has greatly increased now."

Li Yongjie revealed that his team is brewing non-invasive surgery. "This is the next step in surgery and treatment, and it will be a big breakthrough. I am optimistic about it."

On the occasion of Functional Neurosurgery in Fu Zi, it was the time when Alpha Go defeated the top human Weiqi players.

"The brain has 60 billion to 70 billion brain cells. If you regard them as planets, then the brain is as infinite as the universe." Li Yongjie, who is optimistic about brain-computer interface, said excitedly that if we can join hands with engineers, it may connect human imagination and mobility. "That will open up a new world of functional neurosurgery".