Recently, Know Car Emperor released the report "Insight into the Decision-making of Intergenerational Car Buyers from a Vertical Perspective", which comprehensively analyzes the behavioral preferences of intergenerational car buyers from four stages: starting car selection mode, generating car selection interest, precipitating car purchase intention and restoring decision-making characteristics, and interprets the new trend of intergenerational group consumption.

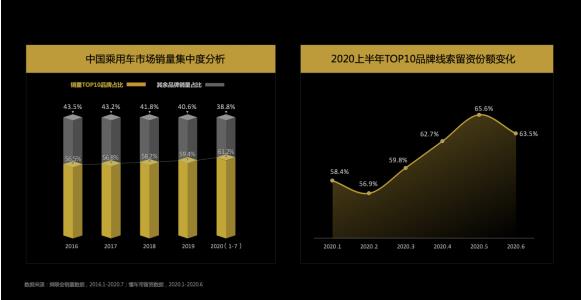

"Report" pointed out that the market concentration characteristics of the automobile market are becoming more and more obvious, and the trend of sales volume gathering to the head brands is getting stronger, and "brand" has become an important keyword in the era of stock. The user’s "brand" sensitivity is gradually stronger and the willingness is significant, and the car buying behavior of young people is more influenced by brand and word of mouth factors.

Car sales are gathering with the head brands, and the sensitivity of users to choose car brands is enhanced.

In recent years, the automobile market in China has gradually moved from the incremental era to the stock era. At present, the head brand effect of automobile sales is remarkable. The proportion of automobile brand sales of TOP10 is increasing year by year, and it has occupied 61.2% of automobile sales in the market from January to July 2020. At the same time, the Report shows that in the first half of 2020, the brand retention share of TOP10 continued to increase, and the brand concentration of users’ retention continued to increase.

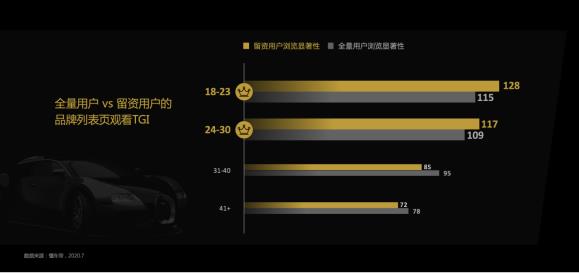

In the stage of car selection, the user’s sensitivity to the brand is also increasing, and the traffic of users arriving at the brand list page is obviously increasing, which is higher than the overall growth performance of knowing the car emperor’s traffic in the same period. For young users, the attention to the brand is significant throughout all stages from car selection to decision-making.

According to the Report, the brand sensitivity of users is enhanced during the attention period. After 90′ s, young users are more inclined to cut through the brand when choosing a car. The browsing significance of brand list pages of users aged 10-30 is over 100, while the older users are less inclined to cut through the brand. After the stage of generating interest and precipitation, young users in the decision-making period will be more sensitive to the brand.

In addition, more and more users find the target model through conditional car selection. According to the Report, from January to July, 2020, the click trend of knowing the car emperor’s conditional car selection showed a fluctuating upward trend, in which the click trend in July increased by 67% compared with that in January, and the growth rate of all click events in the same period was 30.1%. When using conditions to choose a car to buy a car, young users after 90 are more inclined to price and brand, and the car selection conditions are more comprehensive. However, mature users tend to search for models and vehicle factions, and intergenerational people show obvious consumption tendencies.

The influence of "word of mouth and circle" is enhanced, and the decision-making of young users is more influenced by content.

In the stage of generating vehicle interest, the parameter configuration of vehicle models is more concerned, and the force of word-of-mouth public opinion and circle influence with social sharing attributes is gradually enhanced. In addition, the influence of car content on users’ car buying behavior is also rising.

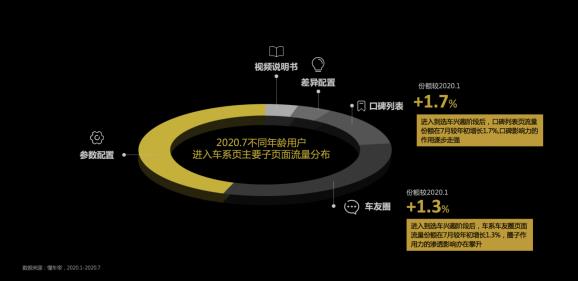

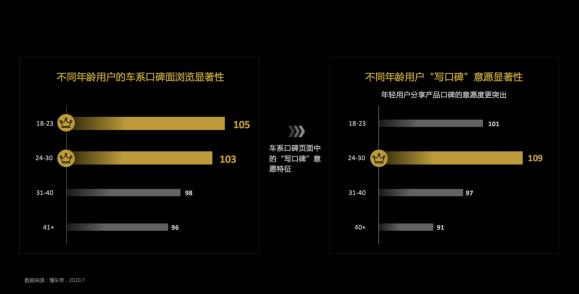

According to the "Report", the traffic share of the word-of-mouth list page of knowing the car emperor increased by 1.7% in July compared with the beginning of the year, and the browsing significance of the car department word-of-mouth of users under the age of 30 exceeded 100. The demand for "avoiding pits" caused by young users’ lack of experience was even more significant. TAs are not only looking at word-of-mouth, but also more willing to share. In the decision-making stage of retention, users who intend to stay in the post-80s and post-90s browse word-of-mouth content significantly. For post-80s users, word-of-mouth has a more significant effect on users with high intention.

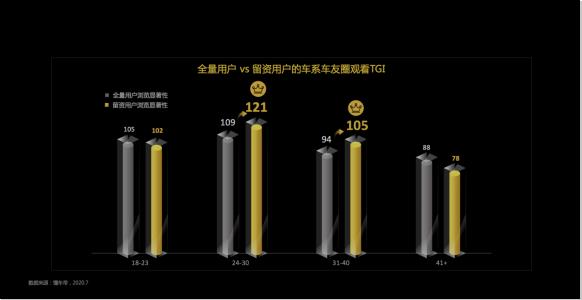

Platform social experience has also become the focus of young people. Knowing that Chedi Cheyou Circle is the "social" position of the car circle, young users after 90 pay more attention to Cheyou Circle. According to the Report, the page traffic share of car riders increased by 1.3% in July compared with the beginning of the year. Compared with middle-aged users, users under the age of 30 prefer to browse the content of car riders, and it is more significant to join the car riders when choosing a car.

Consistent with the performance of word-of-mouth decision-making, users after 1980s and 1990s all showed the characteristics that the browsing significance of car friends circle became more and more obvious with the increase of retention intention. Mature users are sensitive to parameter configuration in the overall decision-making period, but with the enhancement of users’ decision-making intention, this concern feature of young people appears, and the rational observation willingness of TAs in the early decision-making period is obvious.

In addition, the influence of automobile vertical content on the car purchase behavior of user groups has gradually increased. "Report" pointed out that in the stage of generating interest, young users after 1990s are more willing to watch UGC content (user-generated content) in the cycling circle, and TAs are more inclined to learn about vehicle models through interaction and other means. In the decision-making stage, the influence of content becomes more and more obvious with the increase of young users’ decision-making intention. According to the Report, the browsing significance of reserved users in the age range of 18-30 is 110, which is significantly higher than that of full-time users in the same range, and users from 1985 to 1995 are greatly influenced by professional content, and the browsing significance of PGC content pages by users exceeds 100.

Users’ willingness to compare is enhanced, and they are more willing to "spend ahead" after 90.

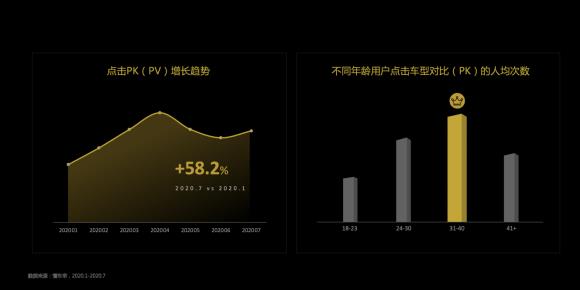

In the precipitation stage after generating interest, the user’s willingness to compare gradually increases, and the comparison ability of the main car buyers after 80 s and 90 s is relatively significant. Understand that the growth trend of clicking on PK(PV) is fluctuating and rising, with an increase of 58.2% in July compared with January. Among them, mature users aged 31-40 click on the vehicle comparison (PK) the most.

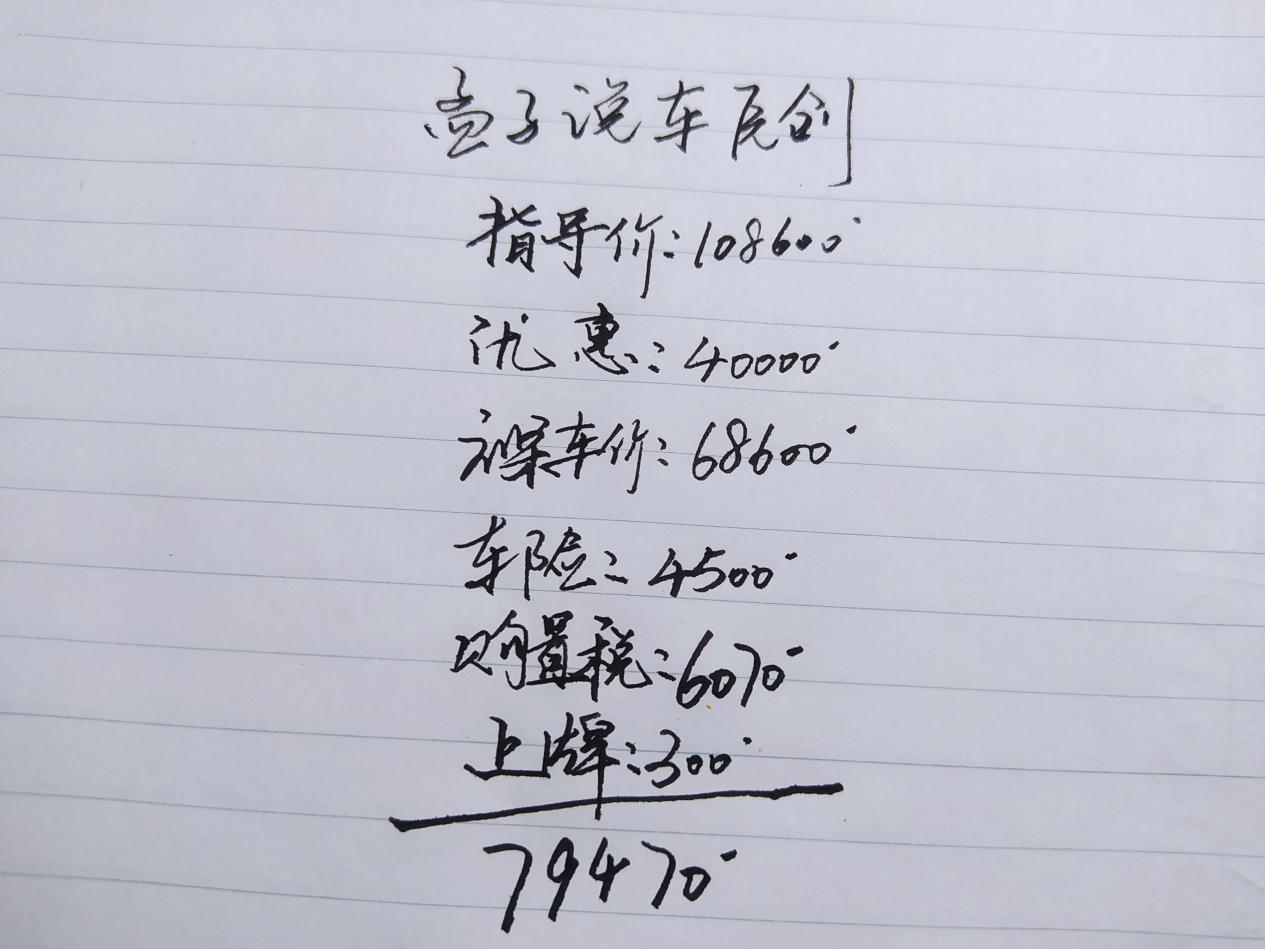

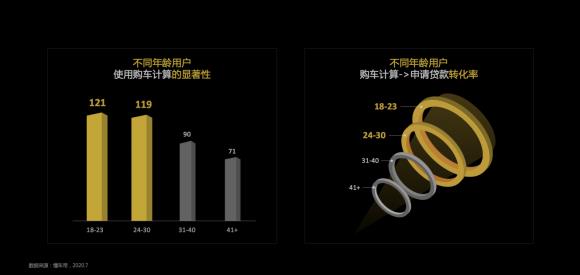

According to the Report, young post-90s users tend to compare the dominant indicators of products, such as the appearance and interior of cars, while older users will pay more attention to weighing the competitiveness of target models from the vehicle configuration and comprehensive level. In addition, disassembling the car price and careful calculation have become more and more important considerations for users to buy cars. The click trend of users in the station car purchase calculation shows a fluctuating growth trend, and the full payment and loan distribution of users are relatively balanced. According to the Report, 52% and 48% of users choose full payment and loan respectively.

It is worth mentioning that the consumption concept of young users is more radical. According to the Report, post-90s users are more sensitive to calculating car prices and have a stronger willingness to "spend ahead of time", and financial penetration is more significant for young users. Among them, the 18-23-year-old car purchase calculation has the highest significance, and the application loan conversion rate accounts for the largest proportion.

On the whole, Knowing Car Emperor released the report "Intergenerational Car Purchase Users’ Decision Insights from a Vertical Perspective", which deconstructed the overall consumption behavior characteristics of the current intergenerational crowd for brand owners, helped brand owners understand the differentiated needs of users, and also provided more professional and valuable information for the automobile industry, so as to promote the development of related industries.