Zhongxin Jingwei Client August 17th (Dong Xiangyi) In the past two days, the news that "the average monthly salary of Tencent employees is 72,700" has been screened on the Internet, and netizens have become "lemon essence" in seconds — — "I am on average with Ma Huateng, and I am also a person with hundreds of billions of dollars." Jokes are jokes, but the high salary of Tencent employees is really beyond the reach of people in the financial circle and IT circle. Looking at the whole country, the figure of 72,700 yuan even exceeds the sum of the per capita disposable income of Shanghai and Beijing in the first half of this year.

Generally speaking, how much employees earn is inseparable from the performance of enterprises. The latest financial report shows that Tencent’s net profit in the second quarter of this year was 23.5 billion yuan, a year-on-year increase of 19%, far exceeding market expectations. BATJ has always been a leader in the Internet industry, and it is not surprising to offer a high salary in order to attract talents widely. In the A-share market, which industry makes the most money? Historical data show that finance and real estate have always been "gold-sucking" industries, and executives at the top of the pyramid are also the most profitable, with annual salaries ranging from tens of millions of yuan to nearly one million yuan.

According to the analysis of Sino-Singapore Jingwei client, as of 15:00 on August 16th, in the first half of 2019, the total cash paid to and for employees by 648 A-share companies that have published semi-annual reports was 266.17 billion yuan. In terms of total amount, China Ping An ranked first with 45.14 billion yuan, followed by China Unicom and Ping An Bank, with 20.66 billion yuan and 11.24 billion yuan respectively. According to statistics, the top 10 A-share companies paid employees a total of 114.93 billion yuan.

It is worth noting that because the number of employees and the pace of accrual are different in each enterprise, enterprises with a large total salary may not have a high monthly salary per capita, and enterprises with a small total salary may not have a low monthly salary per capita.

Who is the most generous?

The financial report of listed companies can’t find the total amount of salary paid by enterprises to employees. The client of Sino-Singapore Jingwei has selected the financial index of "paying employees and cash paid for employees" on Wind, which includes: wages, bonuses, various allowances and subsidies actually paid to employees in this period, as well as social insurance funds, supplementary pension insurance and housing accumulation fund paid for employees.

Wind shows that as of 15:00 on August 16th, in the first half of 2019, the total cash paid by 648 A-share companies that have published semi-annual reports to their employees was 266.17 billion yuan, and the top three companies, China Ping An, China Unicom and Ping An Bank, all exceeded 10 billion yuan, among which China Ping An paid employees 45.14 billion yuan, far ahead.

According to the rough calculation of the Sino-Singapore Jingwei client, the average monthly salary of China Ping An employees is 20,000 yuan. The average monthly salary of employees of China Unicom and Ping An Bank is 14,000 yuan and 56,000 yuan respectively.

In addition, Industrial Fulian, Huaxia Bank, Huaneng International, Hikvision, Kweichow Moutai, Poly Real Estate and Shanghai Port Group rank among the top ten, and the top 10 A-share companies pay a total of 114.93 billion yuan. The industries distributed by the above companies involve telecommunications services, finance, real estate, electronics manufacturing and so on.

On August 15, China Ping An released the semi-annual report for 2019. In the first half of the year, the net profit returned to the mother was 97.68 billion yuan, a year-on-year increase of 68.1%, and the high performance was in line with expectations; In the first half of the year, the operating income was 639.15 billion yuan, up 19.2% year-on-year; The dividend per share was 0.75 yuan, compared with 0.62 yuan in the same period last year.

Minsheng Securities believes that the two main contributions of China Ping An’s high performance growth in the first half of the year are as follows: First, tax cuts are favorable for cash. Non-recurring profit and loss items are positively promoting net profit. The report shows that the one-time tax adjustment of the company has a positive impact on the current net profit of 10.453 billion yuan. After excluding the impact, the non-net profit attributable to the parent company increased by 50.6% year-on-year. Second, the stock market performed well in the first half of the year. In the first half of the year, China Ping An achieved a year-on-year increase in investment income of 31.4%.

China Unicom, which won the second place, disclosed the semi-annual report for 2019 on August 14th. During the reporting period, the company achieved operating income of 132.96 billion yuan, down 1.1% year-on-year. The net profit attributable to the parent company was 3.02 billion yuan, a year-on-year increase of 16.08%. Among them, the operating income and net profit in the second quarter were 71.81 billion yuan and 1.39 billion yuan respectively, the former decreased by 3.2% year-on-year, while the latter increased by 8.6% year-on-year. It is reported that the decline of China Unicom’s operating income is mainly affected by the decline of mobile communication business income, and the increase of the company’s net profit is mainly caused by insisting on differentiated operation, vigorously changing to Internet operation, controlling costs and improving efficiency.

Who is the most "shabby"?

There are listed companies that are generous to employees, and there are also listed companies that are slightly shabby. The Zhongxin Jingwei client combed and found that in the first half of 2019, ST Hongsheng and ST Xiahua "joined hands" at the bottom, and the cash paid to employees and for employees was 2.462 million yuan and 2.523 million yuan respectively.

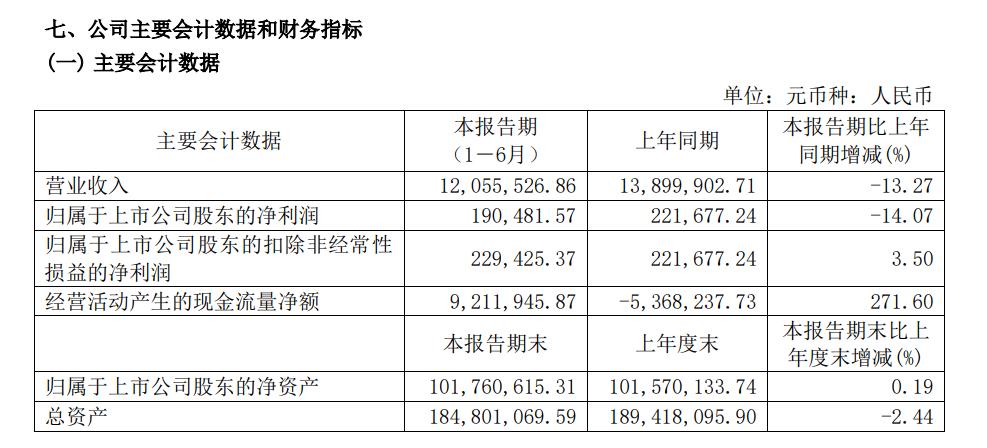

Recently, ST Hongsheng released the semi-annual report for 2019. According to the data, during the reporting period, the company achieved operating income of 12.056 million yuan, down 13.3% year-on-year, mainly because the company stopped operating the water environment restoration business, while the automobile interior business was still in its infancy, and the income scale still needs to be further improved. In addition, the company realized a net profit attributable to shareholders of listed companies of 191,000 yuan, down 14.1% year-on-year. As of the end of the reporting period, the total assets of ST Hongsheng was 190 million yuan, down 2.4% year-on-year.

According to the data, Zhengzhou Deheng Hongsheng Technology Development Co., Ltd. was established in 1992, headquartered in Zhengzhou City, Henan Province, and listed on the main board of Shanghai in 1994. ST Hongsheng completed bankruptcy and reorganization in 2016, and implemented major asset restructuring. The company’s main business changed from the previous financial leasing business to its own house leasing business. In addition, during the reporting period, the company’s main business was automobile interior business.

According to reports, as a listed company that has been warned of delisting risks for years, ST Hongsheng has been engaged in a "shell-keeping" defensive war, and has undergone five reorganizations before and after, and its main business has changed several times. During the "shell-keeping" period, ST Hongsheng has successively sent out contact intentions with Ganzhou Rare Earth, Shanxi Natural Gas, Huawei Nigeria, OCT Technology and many other companies.

It was not until December 2016 that ST Hongsheng ushered in a turning point. At that time, Lhasa Zhihe, a subsidiary of Wang Wenxue, the head of Huaxia Department, transferred the total price for 900 million yuan and took over 20.87% of the shares held by Puming Logistics, the controlling shareholder of ST Hongsheng. Together with the 5% of the shares transferred by Zhang Jincheng, the former investment shareholder, for 140 million yuan, Lhasa Zhihe became the new controlling shareholder of ST Hongsheng, while Wang Wenxue paid only 1.04 billion yuan, which was called the most in its three "shell buying campaigns". It is understood that Wang Wenxue controls a huge capital territory. Apart from ST Hongsheng, he is also the actual controller of several A-share companies such as Huaxia Happiness, Yulong and Visionox.

According to the Securities Times, after two years in ST Hongsheng, Wang Wenxue failed to effectively revitalize this enterprise that was once on the verge of delisting, so he decided to quit, and the takeover party was the brother enterprise of Yutong Bus, another A-share company. On December 7, 2018, Lhasa Zhihe, the controlling shareholder of ST Hongsheng, signed a Share Transfer Agreement with Tibet Deheng, intending to transfer all the 41.64 million shares of ST Hongsheng to Tibet Deheng. After the transfer is completed, the controlling shareholder of the listed company will be changed to Tibet Deheng, and the actual controller will be changed to seven natural persons including Tang Yuxiang.

As can be seen from the stock price trend, since December 2016, the share price of ST Hongsheng has been falling all the way. By the close of December 7, 2018, the market value of all the shares of ST Hongsheng held by Lhasa Zhihe was 363 million yuan, shrinking by over 60%.

Finance and real estate are the most "rich"

The worst company can’t pay a penny.

What is the salary situation of A-share industry and executives in 2018? Wind data shows that from the perspective of the industry, in 2018, the average annual remuneration of financial industry executives reached 22.66 million yuan, far ahead. The real estate industry followed closely, with the average annual remuneration of executives reaching 14.275 million yuan.

The Zhongxin Jingwei client combed and found that according to the 19 commonly used industries classified by the CSRC, the average executive salary of 19 industries in 2018 was 7.956 million yuan, while in 2017, the average executive salary of these 19 industries was 7.302 million yuan, a year-on-year growth rate of 9%.

Wind data shows that from the company level, the total salary of Fangda Special Steel in 2018 is 169 million yuan. The worst is *ST Yida, whose salary showed zero last year. Behind this, *ST Yidain’s annual report was "non-standard" for two consecutive years and its listing was suspended on July 19. Not only that, this A-share "worst" company currently has only two employees, the general manager and the chief financial officer, and its revenue last year was zero. The annual salary of *ST Yangfan, which ranks second to last, is only 525,000 yuan.

From the perspective of specific executive compensation, Zhong Chongwu, the former chairman of Fangda Special Steel (who left office on March 6, 2018) topped the list with an annual salary of 40.351 million yuan. The salary of 11 executives in the company exceeded 10 million yuan. According to statistics, from 2008 to 2018, Zhong Chongwu and Xie Feiming, the two chairmen of Fangda Special Steel, paid a total of 228 million yuan.

However, in sharp contrast to the annual salary of Fangda Special Steel executives, the per capita salary of employees in the company is not high. According to China Economic Net, in 2018, the annual per capita salary of Fangda Special Steel employees was only 165,900 yuan. In this regard, Fangda Special Steel explained in the annual report that the pre-tax salary of senior managers consists of the basic salary in 2018 and the incentive salary in 2017.

In fact, it is nothing new for Fangda Special Steel executives to receive high salaries and pile up a "cash wall" to pay bonuses. However, it is questioned whether Fangda Special Steel excessively pursues performance and rewards, but ignores the importance of safety.

It is reported that in the first half of this year, eight people were killed in two accidents at Fangda Special Steel. In addition, the company’s revenue is not directly proportional to the net profit. According to the semi-annual report of 2019, Fangda Special Steel achieved an operating income of 8.253 billion yuan, an increase of 0.18% year-on-year; The net profit attributable to shareholders of listed companies was 1.055 billion yuan, a year-on-year decrease of 19.19%. (Zhongxin Jingwei APP)